Barley Market Perspectives

07/07/2023

July 7, 2023

HIGHLIGHTS

Seeded area of Canadian barley for 2023 was reported by StatsCan at 7.32 mln acres, up 4% from last year’s 7.04 mln acres and in line with the 5-year average acreage. Acreage gains were led by Alberta, with an 8% increase while Saskatchewan plantings were only 1% larger than last year.

The latest crop ratings for Saskatchewan and Alberta show sizable declines in recent weeks, raising concerns about 2023 yield potential. Conditions are quite variable within western Canada, with the most severe problems in the southern prairies. Dry conditions and hot weather also raise the possibility of higher protein in the barley crop.

Rain has fallen in northern Europe, but forecasts of the spring barley crop have been shrinking in recent weeks due to earlier dryness. According to Stratégie Grains, spring barley production in 2023 could be down 18% from last year for the EU and UK. The winter barley crop is still expected to be 4% larger than last year.

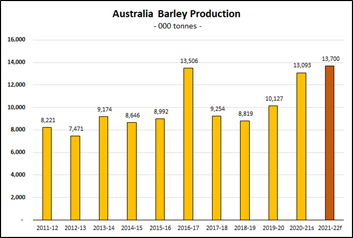

The initial Australian barley crop estimate for 2023/24 from ABARES came in at 9.93 mln tonnes, 30% less than last year and the smallest crop since 2018/19. This was despite a 4% increase in seeded area, as El Niño is expected to reduce yields.

China imported 1.28 mln tonnes of barley in May, the highest monthly amount since November 2021. This barley came from seven different origins, with France, Argentina and Canada the three largest sources.

According to the Argentine Ag Ministry, seeded area of barley for the 2023/24 marketing year is expected at 1.60 mln hectares, 11% less than the 1.80 mln in 2022/23.

The USDA has estimated 2023 US seeded area of barley at 3.36 mln acres, 14% more than last year. The USDA is also reporting the condition of the 2023 crop is deteriorating.

PRICES

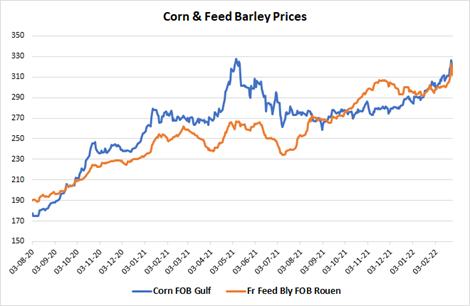

Malt barley prices in key markets are moving generally sideways in recent months and are now mostly below levels seen in 2022 and early 2023. In North America, bids at country elevators are now getting back to levels seen prior to the 2021 drought, with Canadian bids recently dropping toward new-crop levels. At the end of June 28, the average western Canadian elevator bid for malt barley dropped to US$240 per tonne, down from the late 2021 peak near US$400 and close to the spring 2021 levels around $US230 per tonne. Meanwhile, Australian prices are still at the low end of the range as trade has not yet resumed with China. Malt barley prices in Europe are firmer, with gains starting to show up in France due to weather concerns.

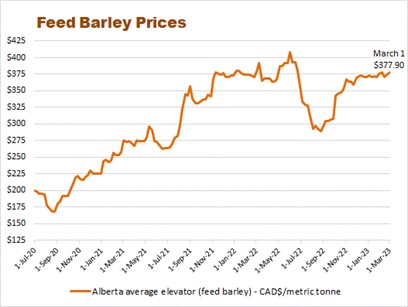

Feed barley prices in these same selected markets have also faded from earlier highs but appear to be stabilizing in recent weeks. The average elevator bid for feed barley in western Canada is US$250-255 per tonne in June 2023, down US$10 per tonne from January 2023 and below the peak of US$310 per tonne a year ago in June 2022. Australian barley prices still represent the low end of the market while Argentine and French prices are declining.

CHINA

In 2022 and early 2023, Chinese barley imports were well below the record levels seen in late 2020 and 2021. Imports from Canada had dropped off when the 2021 North American drought took hold and China shifted its buying to Argentina. Then, when the Argentine crop was reduced, China shifted back to Canadian barley. In the past three months, Chinese buying has ramped up again with the focus on French, Canadian and Argentine barley. It’s also worth noting that more Ukrainian barley started to make its way into China again in May.

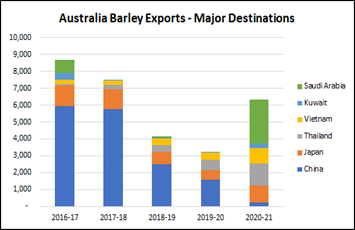

While China’s tariffs on Australian barley imports haven’t been removed yet, officials are working toward a resumption of trade. Prior to the tariffs being imposed in May 2020, Australia had been the largest supplier of feed and malt barley to China. Even with a smaller barley crop in 2023/24, Australia should regain a sizable place within the Chinese market.

EUROPE

While rains in northern Europe have provided some relief recently, dry conditions had already reduced yield potential for the spring barley crop. According to Stratégie Grains, spring barley production for the EU and UK is now forecast at 22.6 mln tonnes, 18% less than the 27.7 mln tonnes in 2022 and even farther below the 5-year average of 30.3 mln tonnes. The largest hit to the spring barley crop occurred in Spain, the EU’s largest spring barley producer, where drought cut the crop nearly in half. The reduction in the spring barley crop will have a sizable influence on the European malt barley market. The winter barley crop, mainly destined for feed, matured earlier and avoided most of the adverse conditions. Stratégie Grains is estimating the winter barley crop at 32.2 mln tonnes, 4% more than last year and above the 5-year average of 29.4 mln tonnes.

BLACK SEA

The USDA is projecting a 2023/24 Russian barley crop of 19.6 mln tonnes, down 9% from last year. Its estimate of the Ukrainian crop is 6.4 mln tonnes, 4% larger than a year ago but well below the pre-war average of 8.7 mln tonnes. Ukrainian barley exports in 2022/23 have reached 2.46 mln tonnes as of April. Volumes are moving steadily higher, as opposed to the normal pattern of a heavy fall shipping program with limited volumes the rest of the year. The largest destinations for Ukrainian barley in recent months have been Turkey, China and Romania.

AUSTRALIA

According to ABARES, the 2023/24 barley crop is forecast at 9.93 mln tonnes, 30% less than last year. This is despite seeded area rising to 4.29 mln hectares, 4% more than a year ago (but still lower than the 5-year average of 4.84 mln hectares). ABARES is forecasting a reduced 2023/24 yield of 2.31 tonnes per hectare due to possible impacts of an El Niño event. This yield would be lower than the 5-year average of 2.58 tonnes per hectare and could be too pessimistic.

During the time Australia was shut out of the Chinese market, it produced three very large barley crops, which needed to find a home. Prior to the trade dispute, Australia relied heavily on China as a market for its barley, both feed and malt. With much larger supplies in 2020/21 through 2022/23, exports shifted heavily to Saudi Arabia, other Middle Eastern countries, Japan and southeast Asia, primarily feed barley, although Australia did make some inroads into new malting barley markets, with Mexico being the largest example at over 300,000 tonnes in each of the last two years

This shift in trade resulted in a much smaller percentage of Australian barley exported as malt barley. In the two years prior to the trade dispute, roughly half of Australian barley exports were malt barley, but that dropped to approximately 10% in the past two and half years.

ARGENTINA

According to the Argentine Ag Ministry, seeded area of barley for 2023/24 is expected at 1.6 mln hectares, down 11% from 1.8 mln in 2022/23, but official yield estimates are not yet available. The USDA is forecasting a 2023/24 Argentine crop at 4.5 mln tonnes, unchanged from last year and just slightly above the 5-year average of 4.4 mln tonnes. With a decline in area, this USDA estimate would imply a solid recovery in the 2023/24 yield from last year’s drought reduced results. While there are concerns about dryness in the country, rainfall in the Buenos Aires province, where malt barley production is concentrated, has been close to average so far in 2022/23.

UNITED STATES

The USDA recently raised its 2023 US barley seeded area estimate to 3.36 mln acres, 14% more than last year and the largest acreage base since 2015/16. Harvested area was estimated at 2.53 mln acres, only 4% more than 2022/23. With the 5-year average yield of 72.9 bu/acre, 2023 production would end up at 184.1 mln bushels (4.0 mln tonnes), 6% more than last year’s crop and the largest since 2016/17. That said, an average yield could be difficult to achieve as the USDA is also reporting that the condition of the 2023 barley crop has been declining. As of June 25, 46% of the barley was rated good or excellent, dropping further below the 10-year average condition at 65% good/exc.

CANADA

In late June, StatsCan updated its estimates of 2023 barley seeded area at 7.32 mln acres, 4% larger than the previous year but in line with the 5-year average area of 7.36 mln acres. Seeded area of barley increased 8% in Alberta and was up 1% in Saskatchewan and BC while acreage showed small declines in other provinces. Plugging in the 5-year average yield (including 2021) of 64.1 bu/acre would result in a 2023 crop of 9.2 mln tonnes, 8% less than 2022/23.

According to the provincial reports, barley crops in the two main producing provinces are deteriorating. As of the last week of June, 63% of Saskatchewan barley was rated good or excellent, a sharp drop from 82% two weeks earlier and now dipping below the 10-year average of 67% good/exc. In Alberta, conditions had improved slightly in mid-June but then declined again to 40% good/exc in late June, far below the 10-year average condition of 72% good/exc.

Canadian barley exports have been running at a strong pace most of the year, but declined to 189,000 tonnes in April, dipping below the average for the month. This brings the year-to-date total for the first three quarters of 2022/23 to 2.52 mln tonnes, well above last year’s drought-reduced amount of 1.83 mln tonnes and ahead of the 5-year average at 2.03 mln tonnes. So far in 2022/23, China has accounted for 84% of Canadian exports, with the US taking another 14% of the total.

Barley Market Perspectives

10/03/2023

March 10, 2023

CANADA BARLEY PRODUCTION, SUPPLY & TRADE UPDATE

With a healthy sized and good quality barley crop in Canada in 2022, the industries that rely on Canadian barley including Canada’s malting industry, international customers of feed and malting barley and the grain exporters that supply them, as well as the domestic livestock sector, saw significant relief this year in the form of increased supply, replenishing severely depleted stocks after the 2021 drought. Still barley prices remain high in Canada supported by historically strong corn and wheat values and good domestic and export demand for both feed and malting barley.

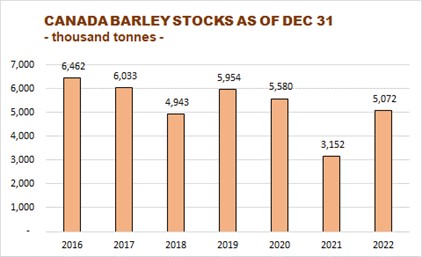

In early February, StatCan released its quarterly stocks report and updated supply and disposition figures for Canadian grains and oilseeds. Not surprisingly, barley stocks as of December 31, 2022, had increased significantly from the end of 2021, up 61% from 3.152 million (M) tonnes to 5.072 M tonnes, although this is still below the long-term historical average of around 6 M tonnes.

Source: StatCan

A majority of the Prairies received adequate moisture during the 2022 growing season (with exceptions such as SW Saskatchewan and southern Alberta) leading to good overall average barley yields estimated at just over 70 bushels per acre across Canada. A generally dry harvest (with exceptions such as parts of Manitoba) contributed to adequate supplies of good quality malting barley from the 2022 harvest.

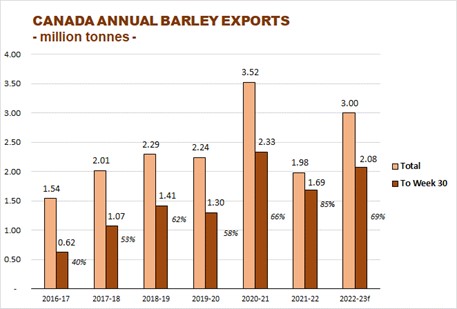

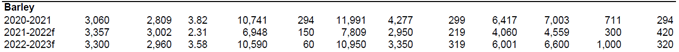

With a strong export pace to date (2.075 M tonnes of barley exported as of week 30 according to the Canadian Grain Commission), AAFC maintained its forecast of Canadian barley exports at 3.67 M tonnes in its February 17 grains report. The figure includes some 700,000 tonnes of processed malt (barley equivalent) exported annually, which translates into about 3 M tonnes of projected barley exports, 1 M tonnes higher than in 2021-22, and 500,000 below 2020-21.

Sources: StatCan, AAFC, CGC

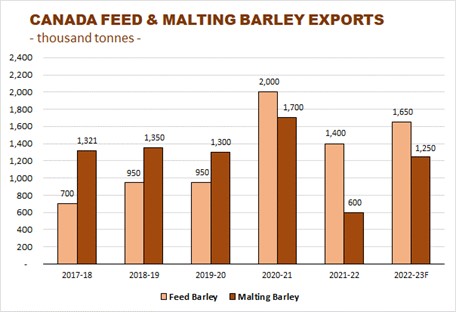

With improved availability this year, exports of malt barley are projected to reach over 1.2 M tonnes, roughly the average of recent years, and a significant increase over 2021-22. In terms of feed barley, continued strong demand early in the marketing year from China has ensured another good export program this year, although in the fall landed corn values in China dropped below barley, slowing the pace of barley purchases and imports.

Source: CMBTC Estimates

BARLEY VALUES

While feed barley prices have come off lately in the key southern Alberta market of Lethbridge market, helped by softening corn prices, barley values across the Prairies have generally been steady over the past couple of months and remain historically firm. A weak Canadian dollar has also been supporting domestic values. Internationally, barley prices have gradually eased since last fall. Ample supply of barley in Europe, good winter barley prospects and slow demand for malting barley so far in 2023 have pressured French prices over the past few months. In Australia, feed barley prices remain depressed by oversupply, although malting barley has firmed in recent months due to poor harvest weather in eastern Australia for the 2022 crop which tightened supply.

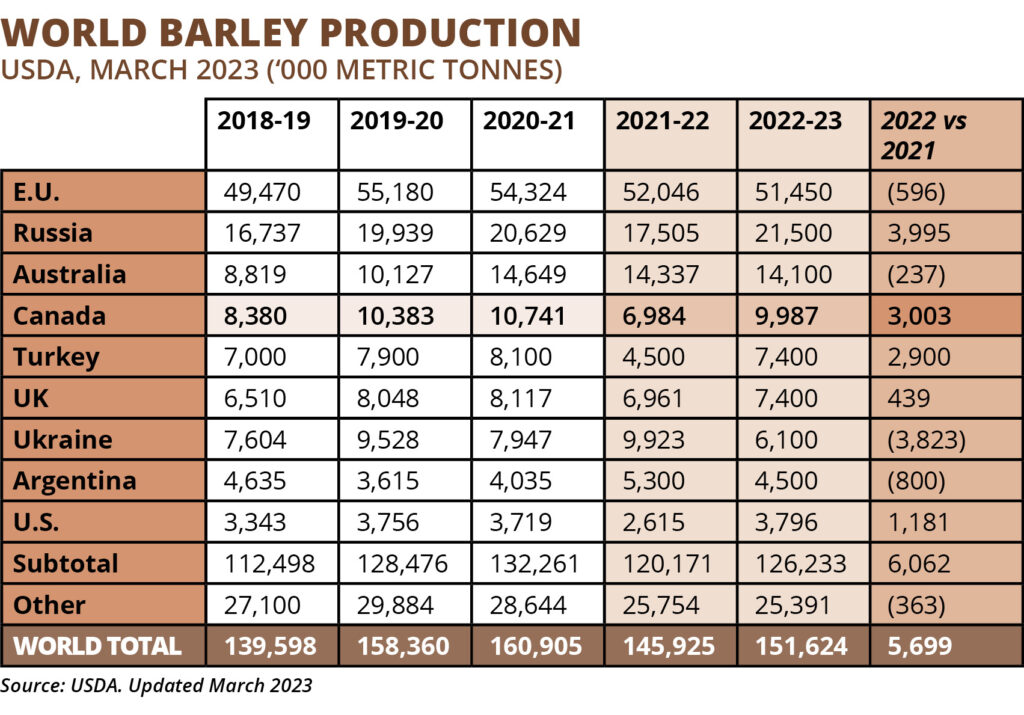

GLOBAL BARLEY PRODUCTION & TRADE UPDATE

In the March USDA World Markets & Trade report, global barley production in 2022 was increased slightly to 151.6 M tonnes, well above 2021 levels, when drought in North America and a smaller Russia crop reduced overall output. Australia’s crop was increased 400,000 tonnes to 14.1 M tonnes, another bumper barley crop which will keep Australia as the world’s largest barley exporter again. A big Russian crop has also resulted in a strong export program, while Argentina’s exports have been curtailed somewhat by a smaller crop due to drought during the last growing season.

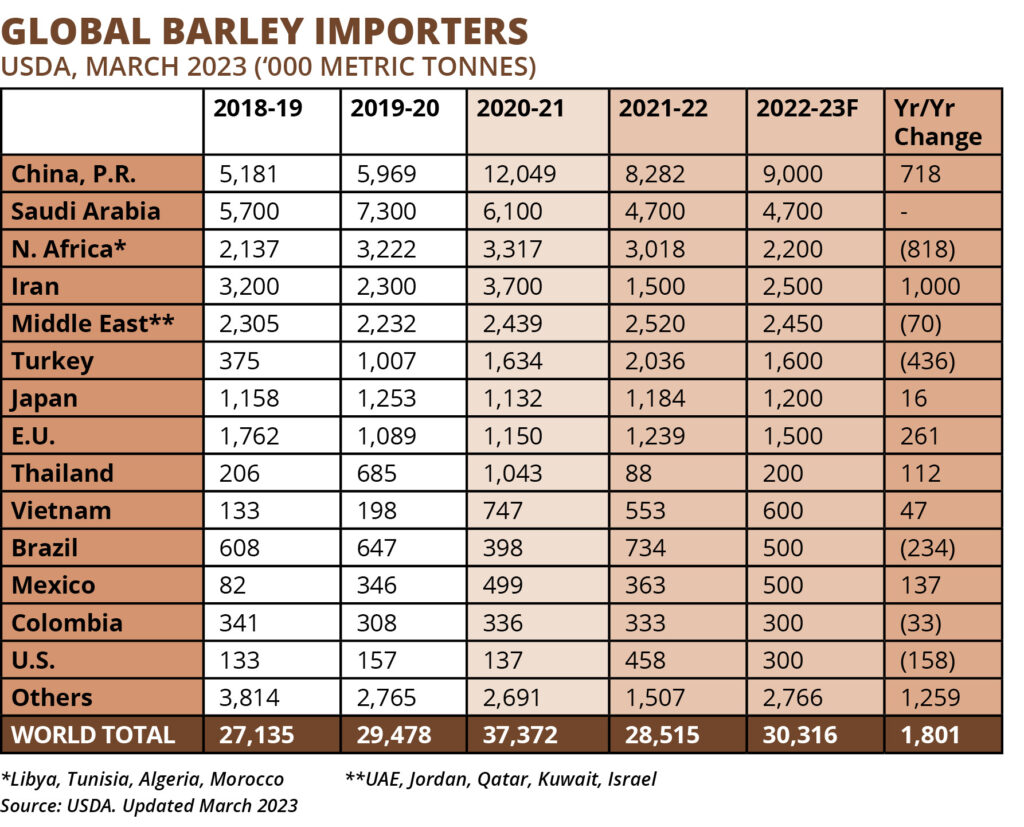

The USDA is projecting global barley trade to rise year over year to 30.3 M tonnes in 2022-23, up 1.8 M tonnes from 2021-22 including an 800,000 tonnes increase in China’s projected imports to 9 M tonnes. However this looks optimistic right now, with only 1.35 M tonnes of barley imported in the first three months of the Oct/Nov year according to Chinese custom data. Still China’s demand for malting barley should remain in the 3-3.5 M tonnes range as it has in recent years. In other markets where malting barley is an important component of overall barley imports, Mexico and Vietnam imports are forecast to be strong at 500,000 and 600,000 tonnes respectively, while Brazil’s imports are forecast lower after a very strong year in 2021-22.

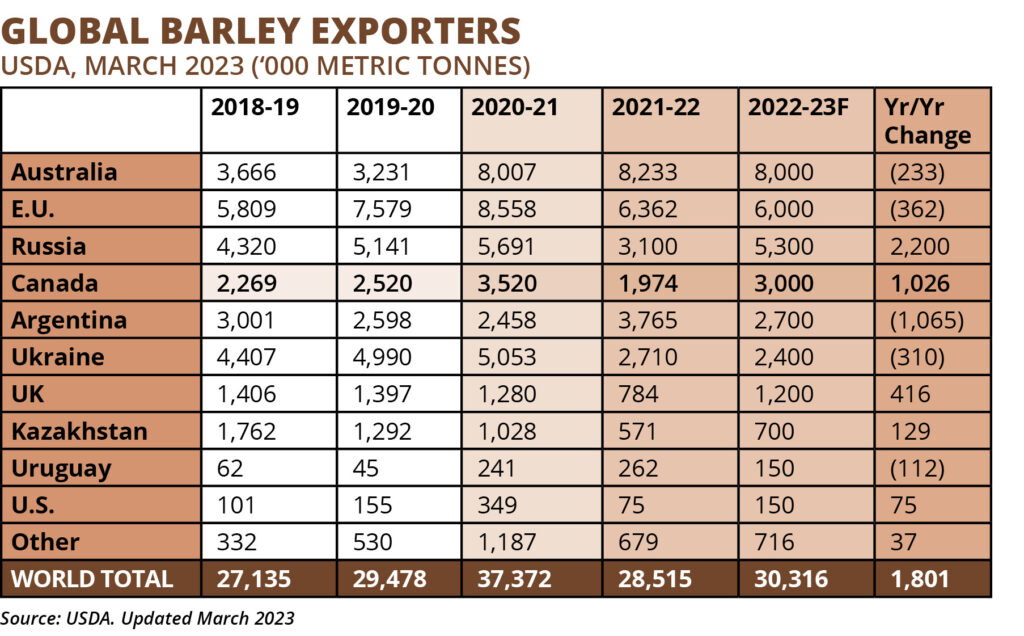

In terms of exporters, with a 3rd bumper crop in a row, Australia is projected to remain the world’s largest barley exporter in 2022-23 at 8 M tonnes, followed by the EU, Russia and then Canada. The USDA export forecast for Canada of 3 M tonnes aligns with AAFC’s export projection. That said, both the EU and Canadian barley export pace has been strong with the potential for both of these forecasts to increase somewhat by the end of the marketing year.

OUTLOOK FOR CANADA IN 2023-24Agriculture and Agri-Food Canada are currently forecasting a small increase in barley seeded area in 2023-24. Based on trend yields, this would keep production steady in the coming year at around 10 M tonnes. Exports are also forecast to remain strong next year, down slightly from 2022-23.

Barley Harvest Update

19/10/2022

| Barley Harvest Progress Update – October 13, 2022

The 2022 crop harvest in western Canada is wrapping up, ahead of the average pace in Saskatchewan and Alberta, while Manitoba’s harvest is about 2 weeks behind normal. Generally, warm and dry weather at the end of August and through much of September on the Prairies allowed farmers to pull off much of this year’s crop without significant delays or quality issues resulting from poor weather, except in parts of Manitoba where a late start coupled with some rains and high humidity during harvest slowed progress. Precipitation in Saskatchewan in mid-September kept producers out of the fields for a few days, but many welcomed the rains after several weeks of dry weather. Some areas of the Prairies saw hard frost in mid-September however cereal crops were sufficiently advanced that neither the precipitation nor the frost is expected to have had a significant negative effect on malt barley quality. The barley harvest is now mostly wrapped up on the Prairies with a few pockets in east and west central Saskatchewan yet to be completed. |

|

| Alberta

Harvest progress continued to advance in the last week of September and early October with favourable weather conditions. Provincially 96.3% of the crops had been harvested as of October 4, similar to last year and well ahead of the historical 10-year average of 76.7%. Well, below-normal precipitation in September allowed producers to work in the fields almost uninterrupted. Most of the barley has been harvested with yields estimated by the Government of Alberta (ASFC) at an average of 74.8 bushels per acre (4.02 tonnes per hectare), above the StatCan estimate of 71.5 bu/acre (3.85 t/ha) from their September 14 report. The absence of precipitation or significant frost events during harvest will help with the supply of good quality malting barley quality this year, much needed after last year’s drought. On September 20 ASFC reported the central region of Alberta had “significantly the highest barley quality region of the province with nearly 50 per cent expected at malt grade”. |

|

| While the dry harvest allowed producers to take the barley off in good condition, concerns are mounting over dry soil conditions in Alberta going into the winter. Precipitation will be needed this fall to help ensure fields have sufficient soil moisture for seeding in the spring of 2023.

Table 3: Alberta Surface Soil Moisture Ratings as of September 27, 2022 |

|

| Source: AFRED/AFSC Crop Reporting Survey |

| Saskatchewan

The weather continued to cooperate for Saskatchewan producers through the end of September and into early October with over 90% of the barley crop combined as of October 3. The central and eastern regions of the province still have some crops to harvest, largely canola and flax, with most of the cereals complete. While overall average barley yields are significantly improved over the 2021 harvest, the southwest and west central regions struggled again this year with very limited rainfall. SaskAg pegs barley yields at 62.0 bu/acre or 3.34 t/ha, just above the 10-year average of 59.2 bu/acre (3.18 t/ha). StatCan estimate of barley yields is slightly higher at 64.1 bu/acre or 3.45 t/ha. Similar to Alberta, there is concern over soil moisture with cropland topsoil moisture in Saskatchewan rated as 28 per cent adequate, 41 per cent short and 31 per cent very short. Precipitation would be welcome ahead of winter. |

|

| Manitoba

As of October 11, harvest progress for all crops in Manitoba is 79%, approximately 2 weeks behind the 5-year average of 89% complete by this time of year (week 40). Periodic rains and high humidity have slowed harvest progress and some crops were harvested tough to damp and had to be artificially dried. Killing frosts arrived in much of the western side of the province on the morning of September 22 and much of the province saw frost on September 27 but the damage is not expected to be significant. Unharvested cereals have seen some bleaching and staining due to the wet weather, especially those in the swath, with some quality downgrades in cereals expected. While much of the malt barley was harvested before the moisture in September, there are reports of some chitting in fields that were wet, often a carryover from the heavy rainfall earlier in the summer. |

|

| Harvesting AAC Connect at Wanesa, Manitoba, August 28, 2022. Good harvest weather this year allowed producers across the Prairies to get their crops off with limited interruption, benefiting malting barley quality. |

| Canada Barley Production & Quality Outlook

On September 14, Statistics Canada released their 2nd model-based crop production estimates for 2022 using satellite imagery to estimate yields. According to these latest figures, production of cereals, oilseed and pulses in Canada are up over 36% compared with last year when western Canada suffered a major drought. According to Statistics Canada, farmers chose to seed more wheat, in particular, this year with an area up 2.1 mln acres (838,000 hectares) or 12.8%, as well as more oats, which was reflected in lower seeded and harvested areas of other crops, with barley down 15% from 2021. But with significantly improved yields of 68.4 bu/ acre or 3.68 tonnes per hectare, barley production in Canada is projected at 9,427,840 tonnes, an increase of 35.5% from 2021 and above the 5-year average of 8.871 mln tonnes. Table 5 |

|

|

| In terms of output by province and region in Canada, Alberta barley production reached 4.83 mln tonnes, followed by Saskatchewan at 3.587 mln tonnes, Manitoba at 664,000 tonnes and eastern Canada seeing production drop this year to 322,000 tonnes. Despite a generally good growing season and adequate rainfall in a large area of the Prairies, the dry conditions in western Saskatchewan and southern Alberta pulled down average yields this year, with all of Canada estimated at 71.1 bu/acre or 3.83 t/ha, although some areas of central Alberta and eastern Saskatchewan saw exceptional yields this year. |

|

|

| Quality

Overall quality indications from the 2022 malt barley crop generally look good with low average moisture content, excellent germination energy, limited disease presence and very little pre-harvest sprouting. The protein content is higher than average, while plump kernels and test weights are below average. The dry harvest in western Canada helped replenish short supplies of malting barley, however strong demand for feed grain will mean the malting industry will have to compete for supply with the livestock sector again this year. |

|

|

| CDC Fraser plot trial, St Albert, Alberta |

Barley Market Perspectives – March 9, 2022

16/05/2022

BARLEY MARKET PERSPECTIVES

March 9, 2022

HIGHLIGHTS

- According to major agriculture analytical organizations such as the USDA and the IGC, the global barley S&D is historically tight. With world ending stocks projected at 16.7 million (mln) tonnes at the end of 2021-22 according to the USDA, that would be the lowest stocks since 1983.

- The war in Ukraine will impact the ability of both countries to export barley and other grains (corn, wheat) through the Black Sea for the foreseeable future. The two countries were projected to export 10.5 million tonnes of barley this year, almost a third of global exports.

- With limited options to source barley before the northern hemisphere new crop, remaining supplies this year will have to come from Australia or possibly Argentina, although even the export logistics in these countries are full well into spring.

- China’s announcement on Feb. 24 they will now accept imports of barley and wheat from all origins in Russia will undoubtedly result in greater feed barley exports from the Black Sea to China in future. Neither Ukraine nor Russia export significant quantities of malting barley.

- With tight barley supplies globally and recent geo-political developments, international barley prices have remained firm with French old crop feed barley rising above US $400 FOB in recent days compared with ~$300 at the beginning of 2022 and ~$250 early last August.

CANADA

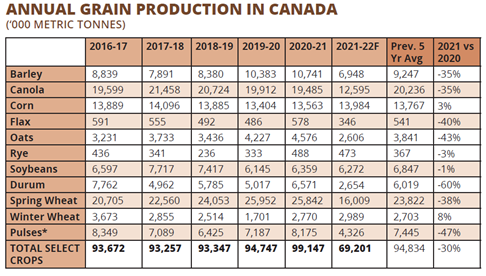

On December 3rd, StatCan released its final estimates for area, yield and production of field crops in Canada for 2021.

- Barley production estimated at 6.948 mln tonnes, including 345,000 tonnes in eastern Canada, smallest barley crop in Canada since 1967 (5.5 mln tonnes).

- Harvested area pegged at 7.4 mln acres, the highest since 2008 (8.7 mln acres).

- Average yields of 43.0 bushels per acre, the lowest since 2002 (41.5).

Canada’s barley exports have been strong to date in 2021 in spite of the small crop, with Aug-Dec totaling 1.513 mln tonnes with China as the major destination. The majority of exports have been feed barley with a small amount of malting barley.

- Canada has been importing significant amounts of corn for the feed sector. As of February 24, there had been over 1.8 mln tonnes of corn exported to Canada from the United States with another 1.6 mln tonnes of sales on the books. AAFC is projecting 4 mln tonnes of corn imports which would be the highest on record.

- Canada will also import malting barley this year to supplement short supplies. Imports will come from origins such as the U.S., Europe and Australia.

GLOBAL EXPORTERS

- In its March report, ABARES (the Australian Bureau of Statistics) increased its Australian 2021 barley production estimate to 13.7 mln tonnes, the highest on record, up from 13.1 mln tonnes in 2020.

Last year (2020-21) Australia exported 8 million tonnes of barley despite a de-facto embargo on exports to China. Australian exports were redirected to Saudi Arabia, Japan, Thailand and Vietnam, among others.

- Australia has also exported malting barley to some non-traditional destinations this year such as Mexico, Peru and Ecuador. Exports are projected at 8.5 mln tonnes in 2021-22.

- In spite of two successive strong export programs, Australia’s barley supplies remain healthy with carry out expected between 2-3 million tonnes at the end of the 2021-22 (estimates vary depending on the source).

- Final estimates of Argentine 2021 barley production are 5.2 mln tonnes, the largest on record. Total barley exports are projected at 3.65 mln tonnes, which would also be a record. With a large barley export program to China of over 2 mln tonnes, exports to traditional destinations such as Colombia, Ecuador and Peru for malting barley, and the Middle East for feed barley, have dropped significantly.

- EU barley exports between Jul 1 – Mar 6 totalled 5.460 mln tones, up slightly from the previous year. With a smaller crop this year (51 mln tonnes vs 54 last year) both the USDA and the European Commission are forecasting EU barley exports down from 8.5 mln tonnes in 2020-21 to 7.5 mln tonnes in 2021-22, down, however based on the export pace to date that may be an underestimate.

CHINA

- China’s 2020-21 barley imports (Oct-Sep) are estimated by the USDA at 12 mln tonnes, an all-time record. All of the increase was in feed barley imports, with China generally taking 3-3.5 mln tones of malting barley annually.

- The USDA import forecast for the 2021-22 is 10.5 mln tonnes. With imports averaging 1.3 mln tonnes a month between Oct-Dec, this would seem an easy target, however with the disruption in the Black Sea, this may drop and China may have to look to the US and Argentina for additional corn supplies.

- Corn prices on China’s Dalian Commodity Exchange have rallied since the harvest low at the end of September of US $395 up to $450 per tonne in early March.

BARLEY PRICES

- Given the tight global S&D, barley prices have remained firm. Recent events have pushed those prices even higher with old crop French feed barley now quoted around US $400 FOB and US Gulf corn quoted at $365 FOB. New crop (2022) French feed barley is now estimated at US $350 per tonne FOB Rouen.

2022-23 OUTLOOK

- AAFC released its first projections for 2022-23 supply and demand in January. The year over year changes in seeded and harvested area are not signficant, and with a return to average yields, the forecast is for barley production of 10.5 mln tonnes in 2022. It is of note that the 2021-22 export forecast of 2.95 mln tonnes is likely on the high side by 300-400,000 tonnes, but with strong domestic demand carry out stocks of 300,000, the tighest on record, are likely in the ball park.

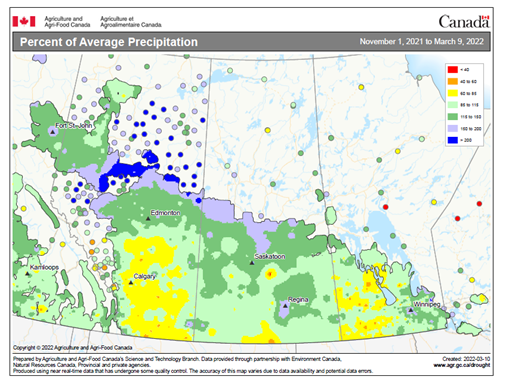

Precipitation on the Prairies has been average to above average in Saskatchewan, below average in a lot of the major growing areas in Alberta, and a mix of average to below average in Manitoba.

- COCERAL (an independent European agricultural trade association) is projecting EU barley area to be up slightly in 2022 to 10.75 mln hectares compared with 10.64 mln ha last year, driven by higher spring barley area, but production down to 51.5 mln tonnes (from 52.2) due to lower yields. Weather conditions have been favourable for crop development so far this winter with French winter barley rated 92% good to excellent, up from 83% a year ago.

- The trade has reported significant sales of 2022 crop French feed barley to China for new crop positions July forward.

- The USDA released its first seeding estimates for 2022 with corn seeded area projected at 92 mln acres, down from 93.4 mln acres in 2021, losing area to wheat and soybeans. The 5-year average is 90.6 mln acres.

BEER

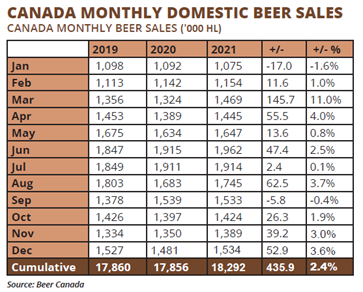

- Canada’s beer sales have remained firm through the pandemic ending 2.4% higher year over year in 2021 vs. 2020.

- Molson Coors reported annual revenue growth in 2021 with net sales up 6.5%, a significant turn around form 2020 when sales were down 8.7% during the pandemic.

- AB InBev reported an increase in the beer sales revenues in 2021, driven in part by a consumer shift to premium brands where revenues were up 20%. Budweiser Brewing, Asia’s largest beer company by sales, said it plans to promore more high-end beer in the Chinese market having seen strong demand growth in this segment in recent years, now over 15% of the beer market.

BARLEY MARKET PERSPECTIVES – OCTOBER 4, 2021

02/12/2021

| Market News

– Both Russia and Argentina currently have barley export taxes in place. Russia increased its tax this week from US$31 to $35.30 per tonne on barley. In Argentina, the export taxes are US $36 on malting barley and $32.40 for feed barley. |

| Supply & Demand Forecasts

In its September markets and trade report, the USDA released the following coarse grain production and trade forecasts: Global 2021 barley production at 149.3 million tonnes, down 11 million tonnes from 2020 due to smaller crops in almost all exporting countries except Ukraine and Argentina. Canada 2021 barley production lowered to 7.8 mln tonnes from 8.8 mln tonnes a month earlier. Russia 2021 barley output reduced from 19 to 18 mln tonnes. U.S. corn production increased to 380.9 mln tonnes, up 20 mln tonnes from last year, using yields of 176.2 bu/acre, just 0.2% below the record. China corn production at a record 273.0 mln tonnes, up 5% from 260.7 mln tonnes last year. |

| Prices

– Although trade has been quiet, barley prices in the EU and Black Sea have been firming due to a lack of sellers as Ukraine focuses on corn exports and Russia continues to increase its export tax, now over US $35 per tonne. French malting barley prices continue to strengthen on strong export sales and quality issues as a result of rains during harvest. |

| 2021 Canada Harvest Progress Update

Most of the barley crop in Western Canada is now in the bin. The combination of this summer’s drought followed by rain during harvest in some regions has resulted in significantly constrained malting barley supplies this year. Early quality indications suggest malting barley protein levels will average above 14% which will create headaches for maltsters and brewers in the coming year. Other parameters such as test weight, plump kernels and germination energy have been remarkably good. |

Barley Market Perspective

01/10/2021

| Global Barley Report – September 15, 2021 2021 PRODUCTION & SUPPLY Argentina: After a very dry period, recent rains in Argentina have boosted crop prospects. Local Argentine analysts are now forecasting 4.5-4.8 mln tonnes of barley output. Australia: Despite smaller seeded area in Australia (down approx. 5%), a good growing season has barley output projections rising with the Australian Bureau of Statistics (ABARES) projecting a 12.5 million tonne barley crop compared with 13.1 mln tonnes in 2020. Harvest will begin in October and run through December. Europe: On August 12, French analyst Strategie Grains reduced the EU barley production estimate by 2 million tonnes to 53 million tonnes due to wet weather in the run-up to harvesting in France and Germany while high temperatures in June lowered yields in Poland and northern Europe. US: US barley production is forecast by the USDA at 106 million bushels (2.3 mln tonnes), down 36% from 2020. If realized, this would be the lowest production since 1900. World: In its September 10 report, the USDA pegged 2021 world barley production at 149.4 million tonnes, down 10.3 million tonnes from 2020 due to smaller crops in almost all exporting countries except Ukraine and Argentina. |

|

| The USDA also forecast global corn production at a record 1.198 bln tonnes, up from 1.117 bln, an increase of 81 mln tonnes or 7.25%, with record crops projected in China, Brazil, Argentina and Ukraine, and the second largest crop ever in the U.S. of 380 mln tonnes, up 20 mln tonnes from 2020 (highest was 384 mln tonnes in 2016). World wheat output is also estimated at is highest ever at 780 mln tonnes, with record crops in China, India, Ukraine and Argentina. CANADA On September 14, Statistics Canada released updated 2021 crop production estimates for Canada (view it here). Barley output is estimated at 7.14 mln tonnes based on yield models using satellite imagery taken in August. On September 8, StatCan released its July 31 stocks report, with Canadian barley stocks at their lowest level on record at 711,100 tonnes, down 25.7% from a year earlier. The decrease was attributable to both lower on-farm (-19.9% to 551, 300 tonnes) and commercial (-40.5% to 159, 800 tonnes) stocks. Deliveries of barley off-farm increased 17.4% to 5.1 million tonnes, contributing to the decrease in on-farm stocks with barley exports up 54.8% year over year to 4.6 million tonnes (includes processed malt). Barley used for feed fell 10.6% year over year to 6.1 million tonnes as of July 31. TRADE On September 6, Reuters news reported that Chinese importers cancelled feed barley purchases from the Black Sea in recent weeks due to weaker than expected domestic demand and expectations for a large corn crop. Ukraine exported 2.8 million tonnes of barley in July and August from their record 2021 barley crop of 10.5 million tonnes. EU barley shipments reached 2.275 million tonnes since July 1, 20% ahead of last year. Major destinations include China, S. Arabia, Jordan and Turkey. Argentina reports having sold for new crop 162, 350 tonnes of malting barley and 1,108,000 mln tonnes of feed barley for January-April 2022 positions. In its September 10 report, the USDA projected 2021-22 global barley trade at 33 mln tonnes, down 865,000 from the previous year due primarily to China and North Africa/Middle East, but still a historically strong barley trade estimate. |

|

| PRICES

Feed barley prices on the Prairies rose significantly during the month of August with prices in Lethbridge reaching over $9.00 per bushel. Prices have since eased slightly as corn begins to arrive in southern Alberta and producers harvest their crops. Rains have downgraded some wheat to feed adding to feed grain supplies, however with the lowest barley stocks on record as of July 31 according to StatCan, prices will remain supported throughout the year. |

|

| Globally both feed and malting barley prices remain strong. With rains at harvest impacting quality and strong demand for French malting barley, spreads have reached near record levels of US $50 per tonne between feed and malting barley prices in France. |

|

| 2021 HARVEST PROGRESS UPDATE As of September 7, Alberta barley harvest was estimated at 56% complete. Average yields of 40.2 bushels per acre compared with the 5-year average of 72.2. As of September 6, Saskatchewan barley harvest was estimated at 66% complete. Average yields of 38.0 bushels per acre compared with the 5-year average of 67.4. As of September 6, Manitoba barley harvest was estimated at 90% complete. Average yields of 48.1 bushels per acre compared with the 5-year average of 69.8.2. |

|

Harvest Progress Report – Sept. 3, 202

16/09/2021

| September 3, 2021 – Crop conditions in Western Canada deteriorated through July and August due to severe drought which affected crop growth and development. Now rainfall is creating more concerns as farmers harvest their crops. The combination of drought and now wet harvest weather in some regions have significantly affected the size and quality of the western Canadian barley crop this year. Statistics Canada projected barley production in their August 31 report at 7.8 million tonnes based on satellite imagery from July. However dry, hot weather persisted well into August and many in the industry believe Canada’s barley production will likely end up closer to 7 million tonnes. The historically small crop as well as significant quality issues will make selecting malt barley a challenge for the Canadian maltsters and exporters. South of the border the US barley crop is also struggling with North Dakota and Montana also severely affected by drought conditions. ALBERTA In Alberta, barley harvested acreage is struggling to get to 40% complete and yields are averaging below 40 bushels per acre. Cool temperatures and wet conditions are now stalling harvest progress. Quality issues are widespread with light test weight, thin kernels and high protein count. All regions will register well below average yields. This region of the province was the most significantly affected with the extreme heat and lack of rainfall. Most of the barley has been harvested with yields averaging 20 bushels (this region often produces barley crops of 100 bushels per acre). Some of the barley harvested is light weight, thin and the protein levels range from 15% to 19%. There will not be much quality malt barley selected from this area. Precipitation and cool temperatures, while welcome, will do very little for this year’s crop other than delay harvest. This area is projected to have higher yielding barley fields than other regions in the 50 to 60 bushel per acre range. Some combines have had to sit idle for a week to ten days waiting to resume harvest. The wet conditions will produce some chitted barley. |

|

| Combining AAC Connect, Penhold, AB, August 25, 2021 North East Region (Smoky Lake, Vermilion, Camrose, Provost) This region had some rain events this summer which helped crop growth, however it is now experiencing precipitation and cool temperatures. The rainfall is delaying harvest and increasing the amount of barley that will be degraded due to chit. Less than 20% of the crop has been harvested and the yields are averaging in the 40–50 bushel range. This region also had some rains to support crop development through the summer months, but wet conditions and cool temperatures are delaying harvest. Early barley yields are averaging 45 bushels per acre, although there is some optimism that the yields will improve as harvest advances. Harvested acres are hovering slightly over 20%. |

|

| Harvesting CDC Copeland, Edmonton area, August 25, 2021 Peace Region (Fairview, Falher, Grande Prairie) The region is marred by wet conditions and cool temperatures which are not helping the crops dry down. Barley harvest is a less than 10% complete. Yields are estimated to be in the 30 bushel per acre range. The wet conditions will lead to some of the unharvested barley to be graded feed quality. In spite of recent rains across many parts of the province, harvest continues to progress quickly with barley harvest across Saskatchewan now 50% complete. The effects of the drought this summer were most damaging in the southwest part of the province. In the last 3 weeks of August, rainfall has caused harvest delays with farmers using the down time to dry their cereal grains. There have also been hail events in the past three weeks that will impact barley production. Many producers in this region have completed harvest, for some it was the lack of grain to harvest that permitted them to finish early, although recent rains have delayed the remaining harvest. Most crop damage this past summer was due to drought stress, along with strong winds that dried the soil and more recently hail damage. The area has also been dealing with a large grasshopper problem and producers are trying to harvest as quickly as possible before more damage is caused. Barley harvest is quickly approaching 50% complete. There was some crop damage the past few weeks due to heavy rains which also produced hail that flattened barley fields. Some producers that harvested early reported decent yields of 60-70 bushels in localized areas. The quality of unharvested will have been impacted by recent rains. East Central Region (Yorkton, Melville) Very little harvest progress has been made in the past two weeks as persistent rains have prevented combines from entering the fields. The weather is forecast to remain dry for the next week. Harvest progress is close to 30% with yields reported from 30-50 bushels per acre. Some usable malt barley has been harvested with a protein band from 13.5-16%. Hailstorms caused damage to some crops this past week. |

|

| Hail Stones in the Yorkton area from August 30 West Central Region (Rosetown, Biggar, Kindersley) The crops in this region suffered due to the intense summer heat and lack of rain. Many crops were either cut for green feed or simply left in the field as there was not much to harvest. Over 40% of the crops are harvested with barley yields being reported in the 20 bushel per acre range. Persistent rains and cool temperatures have halted harvest. The crops are generally in poor condition and yields will be well below average. Some wet barley has been harvested and is being dried. Like other regions hail has damaged some crops in recent weeks. The forecast for the coming week is warm and sunny which will allow harvest to resume. Pesky rains have slowed down harvesting barley in this region, it is now about 25% complete. The temperatures are set to improve this weekend and next week moving into more seasonal average in the low 20°C, which will help dry the crop down. Harvest comprises of some dry barley, but most is damp and must be dried. Barley harvest is mostly wrapped up with about 95% in the bin. Yields are variable ranging between 20-80 bushels per acre. Little to no fusarium damaged kernels in samples so far. Some downgrading is expected on unharvested crops from the recent periods of rain, although the moisture was welcome in many areas to recharge the soil. Barley harvest is largely complete in this region. Some areas received just enough rain during the growing season to produce a decent crop with a few farmers reporting barley yields faring relatively well up to 70-80 bushels per acre, while for others, severe lack of rain resulted in barley crops of 20 bushels or less. There will be some decent quality malting barley available from southwest Manitoba this year. Barley harvest is basically wrapped up in the Red River Valley. Yields have been reported from 30-80 bushels per acre. There were good pockets of malt barley that was harvested before the rains. Wet weather is delaying harvest in this region, with the barley harvest now around 60% complete. Yields are below average for all crops. Contributed by Pat Rowan |

Crop Progress Report – June 24, 2021

05/07/2021

| WESTERN CANADA

Decent rains in the first two weeks of June benefitted the crops and provided temporary relief to regions that were dry. The dry conditions through many parts of the Prairies have been a major concern this growing season. Now the Prairies will see hot dry weather accompanied by windy conditions for the remainder of June, which will have a significant influence on crop development. Many areas will have temperatures around 30°C-35°C, coupled with high overnight temperatures and strong winds, which will cause rapid depletion of topsoil moisture. Southern Alberta and Southwest Saskatchewan are desperately in need of rain to prevent irreversible damage, and in many areas crop yields have already been impacted. There is some precipitation in the forecast this week in these areas but it will be imperative for this moisture to materialize. The Peace Country is also extremely dry and will need rain very soon, as are parts of Southern Manitoba. General rain events of 25 mm (1 inch) will be required for each two-week interval through the end of July to prevent further yield losses in the drier areas, and there are already expectations of below-trend yields for these regions. ALBERTA The Central and North Central regions of the province have been the most favoured with precipitation in the last month, and this has greatly benefitted their soil moisture reserves and prospects for good crops. By contrast the Southern Region has been virtually void of rain in the last 30 days and the soil reserves are depleted. Soil moisture conditions are also very poor in a large area of the Peace Region, with the area around Dawson Creek having only received 35 mm (1 1/4 inch) of rainfall total for the May/June growing period. Southern Region (Lethbridge, Strathmore, Foremost) There has been a general lack of moisture in this region. Since April 1 only 48 mm (2 inches) of precipitation has fallen. Last year, the region received 109 mm (4 1/3 inches) of moisture in June and so far this June has seen only 8 mm (1/3 inch) of rain. The hot dry weather and strong winds have resulted in significant moisture depletion, with plants shutting down in some fields. For many the winter wheat crops have been devastated. More hot temperatures have entered the region this week and the forecast for rain is not promising for the remainder of the month. It looks like less than traditional yields will be the norm for this region. Central Region (Rimbey, Airdrie, Olds) Most parts of the region have received good rains in the last month which, coupled with some warm temperatures, has prompted good crop growth. However, some of the southern parts of the region will need rain soon. Spring seeded cereals are mostly in the tillering stage of crop development. North Central/Northern Region (Barrhead, Edmonton, Camrose, Vermilion, Lloydminster) Most of this region has benefitted from good rains during the growing season – 25 mm (1 inch) of rain has fallen in June, after the region received 66 mm (2 1/2 inches) of moisture in May. This precipitation, combined with some warm temperatures, have the crops progressing well. However, there are still some fields that have excessive moisture like last year. Peace River Region (Fairview, Grande Prairie) Soil moisture levels across much of the Peace Region are down, with a large area in the Central Peace estimated to be near a 50-year low. The crop ratings have dropped from 80% to 70% for the “good to excellent” category. Hot, windy conditions are forecast for mid-week with temperatures reaching up to 35°C, which will certainly stress the crops. Rainfall will be needed soon to avoid any further yield losses. There are some rains in the forecast for mid next week. SASKATCHEWAN The province has been the benefactor of some good rains in the first two weeks of June which has permitted the topsoil conditions to improve and advance the crop development. The southeast region received the most moisture, with Moosomin topping 110 mm (4 1/4 inches) while in the northwest, Lloydminster received 37 mm (1 1/2 inches). This caused flooding on some farms but overall, the rains were a benefit. Crop conditions across the province range mostly from fair to good. The strong winds and heat entering the province this week will add some stress to the crops in areas that are short on moisture, in particular the southwest. Southwest Region (Swift Current, Maple Creek) After good rains in May, ranging between 25-50 mm (1 to 2 inches) the rains have been less generous in June, with rainfall ranging between 6-15 mm (1/2 inch). The crops are limping along and will require some rain very soon to prevent irreversible damage. Southeast Region (Regina, Weyburn, Moosomin) This region has received 75 mm (3 inches) in the Regina area and 110 mm (4 1/4 inches) in the Moosomin area. The crops are advancing quickly in this region because of the good moisture conditions and the heat. The barley development is in the 5-leaf stage. Rains will be needed again by early July to push the crop forward. North Central Region (Saskatoon, Prince Albert, Tisdale) The recent rains and warmer temperatures have been a great benefit to the crops in this region. The major drawback is that strong winds continue to plague the area, depleting soil moisture and interrupting the spraying operations. The barley crop is in the 5-leaf stage. West Central Region (Kindersley, Rosetown, Saskatoon) This region received spotty rainfall in the past two weeks. The Saskatoon area had rains of 38 mm (1.5 inches) and the Rosetown/Kindersley area only received 10 mm. Overall, the moisture was a benefit to the crops that were struggling due to dry crop conditions. Additional rains will be required by month end to maintain good crop development. The barley is at the 5-leaf stage. Northeast Region (Yorkton, Melville) Some areas of the region reported enough rainfall to allow for runoff, while others indicated what they received was hardly enough to counter the wind and heat during the week. The rainfall ranged from 12 mm (1/2 inch) to 50 mm (2 inches). The moisture was hugely beneficial for most farms in the region as the rains permitted some of the crops to recover from recent dry conditions. The heat and strong winds entering the region this week will quickly deplete the moisture. Crop conditions are very good and warm temperatures and a possible rain event this week would advance crop development nicely. Most barley fields are rated either “good” or “excellent” and the barley is at the 5-leaf stage. MANITOBA There have been some decent rainfall events this month, however the weather continues to be highly variable and a combination of hot temperatures and strong winds both contribute to the depletion of the topsoil moisture levels. The abnormally dry weather pattern cycle of expanding dryness has put the crops at risk especially in the southwest corner of the province. More rain will be needed soon. Southern, Central Regions (Winkler, Morden, Brandon) The rainfall this month has ranged from 25 mm in Morris, 50 mm in Winkler and 92 mm in the Brandon area. In most areas the crops are moving forward, however the hot windy conditions are stressing the crops. More rain is needed in the next 10 days. Some crops may be maturing quicker than normal and moving into reproductive stages faster than expected due to drought stress. The barley is in the 6-leaf stage. Northwest Region (Dauphin, Swan River) The region has enjoyed some good rainfall, ranging from 50-70 mm on average in June. Spring cereals across the region are moving into the stem elongation stage, leafing out, and the rows are closing. Cereals are generally in “good to excellent” condition as they have been better able to withstand the challenging spring conditions. Some wheat fields in the Dauphin area are yellowing from excess moisture due to high rainfall amounts the previous week. |

Crop Progress Report – June 8, 2021

30/06/2021

| The rains at the end of May were welcome on the Prairies, with the amounts ranging from 25 cm (1 inch) to 100 cm (4 inches). The month of May was truly variable when it came to temperatures with daytime highs reaching 30°C and corresponding night time temperatures in the low single digits. There were also frost scares, but fortunately the cereals survived without significant damage. Now June is coming in hot and dry in many areas with 30°C plus daily highs in much of the Prairies, and record highs of 38-40°C in the Red River Valley this past Friday, which is well above the normal temperatures for this time of year. And a constant throughout the seeding and early growing season over the past years is the ever-strong arid wind that causes soil depletion and crop damage. There are some exceptions to the rule such as central Alberta where temperatures have been cooler than normal and rains adequate. These areas will require some warmer weather to advance the crop. Looking forward it will be critical that widespread soaking rains develop in the next one to two weeks on the Prairies to avoid yield reductions in the drier areas.

ALBERTA Alberta was mostly dry this past week with strong winds and unseasonal high temperatures which depleted topsoil moisture. The area around Vulcan has been dry and needs immediate rain to avoid major impact on yields. The central and northern areas have received rains, however the temperatures have been below normal which has slowed down crop development. Flea beetles have arrived and spraying operations have commenced. Southern Region (Lethbridge, Strathmore, Foremost) Central Region (Airdrie, Rimbey, Olds) This region has had good rains and are forecast to get additional precipitation this week. The moisture conditions are over 20% excellent, 75% good to fair and 5% poor. The barley is in the three to four leaf stage and farmers are spraying for flea beetles. Like last year this region suffers from below normal temperatures. The area requires heat. Normal temperatures for this time of year are in the low 20 °C, unfortunately the daytime temperatures are in the mid-teens and nighttime temperatures are in the mid to low single digits. Northeast Region (Vermilion, Camrose, Provost) Barley is in the two-leaf stage. There are rains forecast for this week which would push the moisture conditions to over 90% good to excellent. This area is not lacking in moisture – what it requires is warmer temperatures to move the crop forward. Flea beetle activity is increasing and the farmers have commenced spraying when they can get into the fields. Northwest Region (Barrhead, Edmonton, Leduc) Barley is in the three to four leaf stage with 25% of the fields sprayed for flea beetles. The region is generally wet with more precipitation forecast for the entire week. This is another region that has had below normal temperatures and will require some heat to move the crop forward. Like last year, daytime temperatures are in the mid-teens. The crop needs some warmer temperatures to advance crop growth. Peace Region (Fairview, Falher, Grande Prairie) Crop development is modest as the region has sufficient soil moisture with 90% rated fair to good and 5% excellent. These numbers should improve after this week’s rains. Similar to the central region heat is required to move the crop forward. Daytime temperatures only average in the mid-teens and nighttime temperatures are continually in single digits which slows down crop development. SASKATCHEWAN The May rains from two weeks ago got many crops germinating/growing quickly. This past week there was excessive heat with temperatures scaling into the high 30 °C. The heat was accompanied by savanna type winds which played havoc with spraying operations and depleting topsoil moisture. Fortunately there are rain events forecast for most of this week in the northern regions of the province. Here again the flea beetles have appeared and are a major issue especially in the northern parts of the province. The frost that the province had some ten days ago did not inflect much damage on the crop. Overall, not much for re-seeding because of the cool weather, but a bit did happen in the last ten days in northern geographies. The forecast rain events are needed to help alleviate dry conditions that are a concern in many areas. Southwest Region (Swift Current, Maple Creek, Assiniboia) This region registered some limited rainfall in the last half of the month of May which provided good germination and crop emergence. The recent weather conditions have turned dry with no precipitation and strong winds which have reduced topsoil moisture. More rain will be needed relatively soon to reduce any negative impact on yield potential. The topsoil moisture rating show 60% adequate, 30% short and 10% very short. Rain events are forecast for this week which would favorably move the crop forward. The strong winds of the past week have played havoc with spraying operations. West Central Region (Rosetown & Kindersley) The region had some May rains that helped the crops to germinate and emerge. This past week strong winds and warm temperatures eroded some of the topsoil moisture and rain will be needed to recharge the topsoil. The forecast for this week is optimistic, there are rain events scheduled for the entire week. Good precipitation would go a long way to improve crop conditions. Topsoil moisture ratings are 55% adequate, 33% short and 12% very short. North Central Region (Prince Albert, Tisdale) The region has had good moisture conditions and benefitted from some light rains in late May which helped the crop emergence. The growth has moved forward with warm temperatures in the past week. Spraying has been a challenge with the windy conditions, however due to the infestation of flea beetles the spraying will have to resume as soon as the conditions permit. More rain events are forecast mid-week and into the weekend. The barley crops are in good condition. Southeast Region (Regina, Weyburn, Moosomin) Dry conditions this past week along with wind and temperatures into the mid to high 30 °C depleted topsoil moisture. Although the crops were off to good emergence and growth, rain is needed to sustain the crop. It is forecast to rain all this week which would be a major positive impact on crop development. Like other regions, the flea beetles are ever present and spraying operations are going when the windy conditions abate. Northeast Region (Melville, Yorkton) MANITOBA Every region had temperatures drop below freezing the May 24 May long weekend, down to -5 °C for several hours in some areas. Fortunately, the damage was minimal. This past week saw blistering temperatures reaching 40 ° plus in the southern sections of the Red River Valley. The combination of heat and strong winds are not a favorable combination for growth development and just adds stress to the crop. Rains are needed in all regions to replace the drop in topsoil moisture. Southern Region Central and Northern Region (Dauphin) With the heat and excessive winds this week, much of the moisture was lost from last week’s rain in the top one and a half inches of soil. The older cereals are advancing well but some of the later seeded crop is showing heat stress. The entire region will need rain again soon. There is rain in the forecast for the entire week which will greatly benefit the crop growth. For the limited moisture the crops have received since seeding, they are looking good overall. Spraying for flea beetles has gone into full swing as this has become the priority for farmers. Contributed by Pat Rowan |

Crop Progress Report – May 21, 2021

| This report may not be reproduced or redistributed in whole or in part without permission of the Canadian Malting Barley Technical Centre.

Significant seeding progress has been made across the Prairies, this past week. As most of the West was dry and there have not been many interruptions to slow farmers from planting the crop. Most of the barley acres have been seeded in the southern and central regions of the West. Most regions seeded in a limited amount of subsoil moisture sufficient to get the crops to germinate. Fortunately, there have been some scattered rain events benefiting many regions and more moisture is forecast throughout the prairies for the next four days which will be well timed to advance the newly seeded barley crop. ALBERTA |

|

| Kindersley, Saskatchewan May 20, 2021 |

| Southeast Region (Regina, Weyburn, Moosomin) Seeding is over 80% completed and the area has received some moisture. The forecast predicts more throughout the weekend and well into next week. Hopefully the rain events will materialize as this would advance the crop development. North Central (Saskatoon, Prince Albert, Tisdale) This region has been extremely dry, especially the area from Saskatoon to Prince Albert. Rain events are forecast for the next seven days, the moisture would be welcome as the crop is stressed due to the lack of precipitation. There was sufficient sub-soil moisture to germinate the crop, but it requires rain now to advance crop development. Northeast (Yorkton, Melville) This region is over 85% completed for barley seeding. It had been very dry and presently it is snowing. The forecast for the next 72 hours is a combination of snow & rain. The moisture is appreciated. There is more rain events forecast for later in the coming week. Like the other regions, warmer weather would benefit crop development. MANITOBA This past week the province enjoyed above normal temperatures with a few days getting above 30 degrees Celsius. This warmer weather helped speed up the seeding and germination of the seeded acres. Lack of rainfall, throughout the province had been a major concern for crop development, however rain late this week brought 25 mm (1 inch) to most of the southern and central regions of the province. Southern Regions This region is 90% complete seeding. A combination of no rain and savanna like winds were depleting whatever moisture that was in the soil, however in the past 48 hours most of the region received 25 mm of rain (1 inch) and there is more rain, in the forecast, for the weekend, which would be a great boast to the crop growth. |

|

| Barley field in Wawanesa, May 20, 2021 |

| Central/Northern Regions The warmer weather this past week has spurred on the seeding in these regions. Good rains in the last 48 hours and forecast for more will aid crop development. Seeding is around 75% complete and should be done by month-end. Contributed by Pat Rowan |